Newly Approved OTC Eye Drop Could Boost Valeant Turnaround Outlook

This article was originally published in The Pink Sheet

Executive Summary

Valeant's Bausch + Lomb subsidiary will have market exclusivity for Lumify, the first OTC brimonidine eye drop. It likely will provide a needed revenue boost as the parent firm navigates a turnaround after incurring more than $30bn debt during the turbulent period under previous management.

Bausch & Lomb Inc. plans in 2018 to launch the first US OTC ophthalmic solution containing brimonidine tartrate, emphasizing that it differs from the currently available nonprescription ingredient to relieve ocular redness by selectively constricting veins in the eye.

With market exclusivity for Lumify as the first OTC brimonidine eye drop, Bausch + Lomb likely will provide a significant revenue boost for parent firm Valeant Pharmaceuticals International Inc., which is navigating a turnaround following a turbulent period under its previous management.

FDA's Dec. 22 approval letter to Bausch + Lomb notes Lumify was cleared as a 0.025% brimonidine tartrate solution for the relief of redness of the eye due to minor eye irritations.

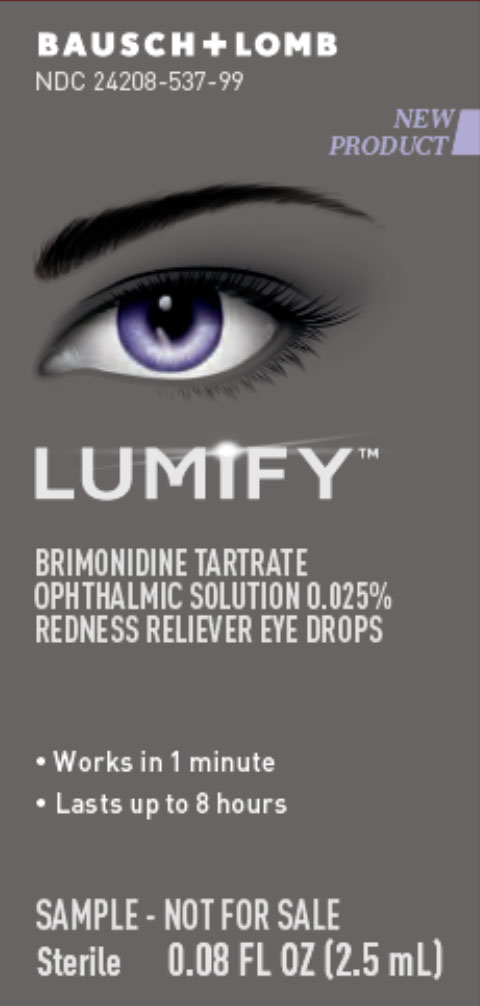

The front of a sample package of Valeant subsidiary Bausch + Lomb's Lumify brimonidine eye drops, which FDA approved on Dec. 22 as the first OTC formulation of the ingredient.

In a same-day release, Valeant said it expects Lumify will be available at US retailers in the second quarter of 2018. A Valeant spokesman said Bridgewater, N.J.-based Bausch + Lomb will have three-year market exclusivity for Lumify.

FDA has authority under the Hatch-Waxman Act to grant the exclusivity to OTC switches proposed in applications for which the agency required clinical trials. Rx brimonidine tartrate ophthalmic solutions in higher dosages, initially approved in 1996, remain available, including from Bausch + Lomb.

According to the National Institute of Health's Clinicaltrials.gov registry, Bausch + Lomb in 2013 and 2014 conducted three clinical trials on the safety of brimonidine 0.025% ophthalmic solution. The most recent, a 507-subject study completed in June 2014, featured children as well as adults, with at least 51% of the participants more than 40 years old.

Results of the three studies are not included in each of the clinicaltrials.gov listings, and none of the studies were identified explicitly as trials of consumers' nonprescription use of brimonidine ophthalmic solution.

Bausch + Lomb worked with ORA Inc. on the two earlier studies, which included adults and geriatric subjects. It licensed the brimonidine product from Eye Therapies Inc. ( (Also see "Deals Shaping The Medical Industry, March 2013" - In Vivo, 4 Mar, 2013.))

Lower Tachyphylaxis Risk

Lumify will launch with a label indication of "relief of redness of the eye due to minor eye irritations," an alternative to tetrahydrozoline hydrochloride 0.05%, the current ophthalmic solution indicated for redness relief available in the US that firms market under an FDA monograph.

|

OTC Monograph Ingredients Provide Relief, Protection |

|

|

Indication |

Formulation |

|

Relief of redness of the eye due to minor eye irritations. |

Tetrahydrozoline HCl 0.05%. |

|

Relief of redness of the eye due to minor eye irritations; for use as a protectant against further irritation or to relieve dryness of the eye. |

Tetrahydrozoline HCl 0.5%; lubricants dextran 70 0.1%, polyethylene glycol 400 1%, povidone 1%. |

|

Temporary relief of burning and irritation due to dryness of the eye; for use as a protectant against further irritation or to relieve dryness of the eye; relieves redness of the eye due to minor eye irritations. |

Tetrahydrozoline HCl 0.05%; lubricants glycerin 0.2%, hypromellose 0.36%, polyethylene glycol 400 1%; astringent zinc sulfate. |

Tetrahydrozoline is the ingredient in leading OTC eye drops from national and store brands and private label lines indicated for redness relief, and in line extensions with additional active ingredients and labeled with other indications (see table).

Other OTC monograph ingredients with the same indication as tetrahydrozoline 0.05% are used in ophthalmic solution formulations that also include antihistamine ingredients and are labeled for allergy relief, their primary marketing target.

Laval, Quebec-based Valeant stated in its release that tetrahydrozoline is a non-selective solution that constricts blood vessels in the eye and can result in users developing a tolerance to the ingredient, causing "loss of effectiveness, as well as rebound redness."

Lumify will face OTC eye redness relief competition from tetrahydrozoline ophthalmic solution lines including Prestige Brands' Clear Eyes and Johnson & Johnson Consumer's Visine.

Brimonidine 0.025%, however, selectively constricts veins, increasing the availability of oxygen to surrounding tissue and reducing the potential risk of the ingredient losing its effectiveness due to tachyphylaxis, users' acute, sudden decrease in response to a drug.

Valeant's release includes a statement by Paul Karpecki, an ophthalmic doctor and director of corneal services at Kentucky Eye Institute, that tachyphylaxis may lead to overuse and potential corneal toxicity and that Lumify "is a very exciting option that I look forward to recommending to my patients."

Slow Period For OTC Switches

Eye drops for redness or other indications are not the most highly anticipated additions to the US OTC market, but moving any ingredient from Rx to nonprescription distribution provides a welcome jolt to the industry largely stymied by FDA in the switch arena.

CDER encourages firms to inquire about developing applications to switch Rx ingredients indicated for chronic conditions, led by high cholesterol, and for five years it has considered stakeholders' comments on its Nonprescription Safe Use Regulatory Expansion initiative, considering potential changes in its switch application and approval process so sponsors could propose novel switches. (Also see "CDER Talks Switches, Monograph 'More Than Ever,' But Mum On Changes" - Pink Sheet, 23 May, 2016.) However, the absence of guidance or a rulemaking from FDA around NSURE and the failure of three switch applications for an Rx statin, as well as the end of a fourth application before it was submitted, has discouraged firms from submitting novel switch proposals. (Also see "FDA's OTC Naloxone Study Is A Starting Point For Other Switches, Not A Roadmap" - Pink Sheet, 16 May, 2017.)

FDA's most recent OTC switch approval came in June for Galderma Laboratories L.P.'s Differin Gel (adapalene gel 0.1%), the first OTC acne ingredient approved in the US in 20 years. (Also see "Differin Gel Enters Changed Marketplace Since Last OTC Acne Drug Approval" - Pink Sheet, 22 Aug, 2016.)

Valeant Post-Turbulence Vision

Valeant could use launches of sales drivers to boost revenues after a lengthy period under previous management that began with serial acquisitions and ended with scandals about high drug prices, a questionable relationship with a specialty pharmacy and accounting procedures that led to legal and regulatory investigations. (Also see "Valeant On Track With Debt-Reduction Goals, But Will It Be Enough?" - Scrip, 9 May, 2017.)

Bausch + Lomb was one of Valeant's additions, absorbed for $8.7bn in 2013. (Also see "Bausch + Lomb Buy Vaults Valeant Into Consumer Eye Care Space" - Pink Sheet, 3 Jun, 2013.)

The current management, led by CEO Joseph Papa, has been selling off assets to ease the more than $30bn debt burden the Canadian firm had incurred.

Valeant in November reported better-than-expected earnings for the third quarter with net income of $1.30bn after loss of $1.22bn for year-ago period, though revenues fell 10.5% to $2.22bn. The firm said it had reduced total debt by about $6bn since the 2016 first quarter, reducing the total to around $27bn. (Also see "Valeant Returns $1bn Female Libido Drug For Free" - Scrip, 7 Nov, 2017.)

The firm's share price dropped the day of the Lumify approval announcement, the final day of trading before a three-day break in the US for the Christmas holiday. It bounced on Dec. 26 from an opening of $21.89 to $22.20 but closed at $21.65 and continued downward the rest of the week and was at $21.10 in trading through mid-afternoon on Dec. 29.

Analysts have yet to note Valeant's OTC switch win, but have identified Bausch + Lomb, including its OTC lines, as a pillar of the firm's future, along with its international business and its Salix Pharmaceuticals Ltd. unit, which markets the irritable bowel syndrome drug Xifaxan (rifaximin).

"The company’s ability to grow these durable businesses will be critical for the stock, in our view," Deutsche Bank Markets Research analysts said in a Nov. 16 research note.

On Dec. 1, BTIG Equity Research analysts were more definite about Bausch + Lomb's value to Valeant. "Bausch + Lomb appears to be [Valeant's] strongest segment, benefiting from its global presence, and new contact lens product offerings," the say.

"In sum, we think the turnaround at the Co. remains a work in progress," the BTIG analysts add.

From the editors of the Tan Sheet.