Bausch Health Has Full Plate While Trimming Debt, Setting Table For Bausch + Lomb Separation

With Decision Pending On Spinout Method, SEC Form For IPO Filed

Executive Summary

Bausch Health says it’s continuing a recovery from the disaster previous management left, when the firm operated as Valeant Pharmaceuticals, even though it reported a $595m net loss for Q2. “We've been trying to solve this debt issue for the company,” says CEO Joseph Papa.

Bausch Health Companies Inc. adds more to its reorganizing plate with each space that opens from moving a piece off while the main course still is under preparation – separation of its Bausch + Lomb Inc. division into a standalone business.

With its second-quarter results on 3 August, the Canadian firm offered an appetizer for its Bausch + Lomb plans. Although it won’t say how it will separate the business until October, Bausch Health announced that for Bausch + Lomb it has filed with the Securities & Exchange Commission an S-1 form, an initial registration required by the SEC for new securities for public companies based in the US.

It’s also filed an S-1 as well as announced IPO plans for its Solta Medical aesthetics business by the end of the year as “an important step in the previously announced spinoff of the Bausch + Lomb eye health business.”

It announced another step in reducing debt created by the previous management with a $350m redemption of outstanding senior notes, using cash on hand and cash generated from operations.

And Bausch Health prefaced its results-day releases by announcing a day earlier that it along with other investors completed the sale of all equity in Egyptian firm m Amoun Pharmaceutical Company S.A.E. to Abu-Dhabi holding company ADQ for total consideration of around $740m subject to adjustments.

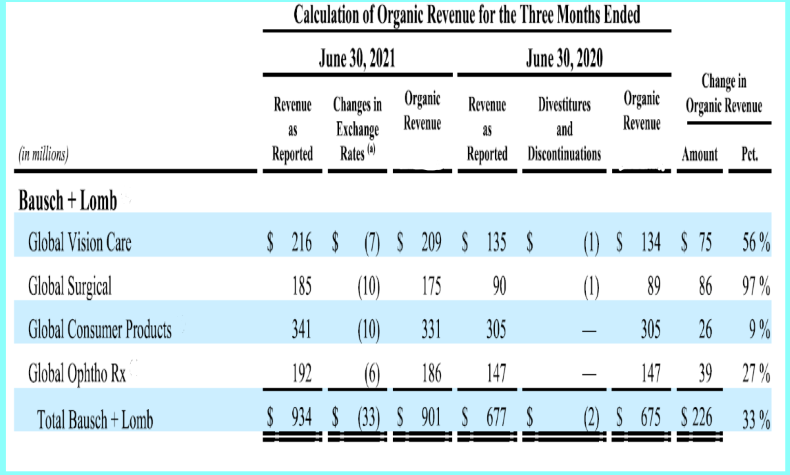

Bausch + Lomb's Q2 Results |

|

|

With those moves as background, CEO Joseph Papa said during the firm’s earnings briefing, “Our second quarter results demonstrate that recovery remains in progress. Our business is generating strong cash flow from operations, which has enabled us to make great progress paying down our debt.”

Bausch Health can say it’s continuing a recovery from the disaster previous management left, when the Laval, Quebec-based firm operated as Valeant Pharmaceuticals International Inc., even though it reported a $595m net loss for the April-June period.

The loss is $269m more than the firm’s net loss in the year-ago period and was primarily due to unfavorable change in its operating results coupled with a decrease in the benefit from income taxes, according to its earnings release.

“If you think about what we've been trying to solve is we've been trying to solve this debt issue for the company, I think everybody realizes that we've had a debt issue,” Papa said during the briefing.

Consumer Healthy But Slowest Segment

Bausch Health reported 38% growth, or 33% organically in Bausch + Lomb revenues to $934m for the quarter. Sales growth for Bausch + Lomb’s consumer health lineup of vision care OTC drugs and dietary supplements was a healthy 9% organically, but the rate lagged well behind the other, all Rx segments of the business (see table above).

CEO Jospeh papa: “Our view on the B&L spin is we will complete all of the necessary internal objectives to be ready after October 1."

Source: Bausch Health

CEO Jospeh papa: “Our view on the B&L spin is we will complete all of the necessary internal objectives to be ready after October 1."

Source: Bausch Health

Papa noted Ocuvite and PreserVision supplements and Lumify eye drops drove Bausch + Lomb consumer sales.

The segment’s results were slowed by a recall of “a limited number of affected lots” of a multipurpose solution due to quality-control problem at a third-party supplier of sterilization services for lens care solution bottles and caps at the Milan, Italy facility, which has since returned to full production capacity. Around $30m of the expected $50m total impact from the recall is reflected in the second-quarter results.

According to an April release, Bausch + Lomb recalled Biotrue, ReNu, Boston, Sensitive Eyes and EasySept and Ophtaxia brand and private label brand contact lens solutions and other OTC eye care products. from consumers, pharmacies, eye care professionals, retailers, distributors and wholesalers. The recalled products were available in all or some of markets including Europe, the Middle East, Africa, Russia and the Commonwealth of Independent States and Hong Kong and China.

Separation Method Still TBD

Even with an S-1 filed with the SEC for Bausch + Lomb, Papa isn’t ready to say an IPO is the firm’s pick for separating the business, which he will head as CEO.

Valeant Litigation Lingers

Preparation for the Bausch + Lomb separation shouldn’t be impeded by the shareholders’ complaint alleging security violations stemming from the Valeant operations. The complaint initially was filed in New Jersey federal court in 2015 and amended in 2018; plans for separating Bausch + Lomb were announced in August 2020. (Also see "Included In Bausch’s Planned Spin-Off, Consumer Brands Account For 3 Spots In Its Top 10 List" - HBW Insight, 10 Aug, 2020.)

“We believe that the Bausch & Lomb spin-off has no connection to the pending litigation, and we think that we announced the B&L spin-off going back now a year ago,” Papa said.

He pointed out Bausch Health in 2019 agreed to pay $1.21bn to settle a class action complaint by shareholders alleging malfeance by Valeant management as share prices during during 2013 through 2015. (Also see "Finance Watch: Forma Raises $100m In Quest To Become A Sickle Cell Leader" - Scrip, 20 Dec, 2019.)

“We don't think there's any legal basis for the concerns raised by the plaintiffs. And we believe it is merely a litigation tactic that they are employing to go forward with this,” Papa said.

Bausch Health has been adding consumer health assets to Bausch + Lomb’s lineup since announcing the separation plan. The latest addition came in July with Biotrue brand Hydration Boost Lubricant, a moisturizing eye drop that can be used while wearing soft contact lenses, and Micellar Eyelid Cleansing Wipes. (Also see "Bausch Health Lubricates Bausch + Lomb's Pending Separation With Hydration Eye Drops Launch" - HBW Insight, 12 Jul, 2021.)

Bausch Health has said at the end of the current quarter it will decide how to divest Bausch + Lomb. In addition to an IPO, a sale and a spinoff are options the firm has mentioned for creating a standalone Bausch + Lomb. (Also see "Bausch CEO Papa Will Head Eye Health Biz Under Strategic Review" - HBW Insight, 5 May, 2021.)

Revenues from a Solta Medical IPO are part of the preparations the firm anticipates completing before declaring its Bausch + Lomb separation method.

“Our view on the B&L spin is we will complete all of the necessary internal objectives to be ready for B&L spin after October 1, 2021. However … we do need to sort through the debt issues in front of us to get to the debt targets that we've previously talked about. And our view is that the Solta IPO will unlock value of Solta,” Papa said in response to a question about completing the separation.

“I'm not going to give a specific timing for the B&L other than saying we will be ready after October 1, 2021. We just need to solve all the debt question … we've made great progress in what we paid down already this year based on the sale of the Amoun business,” he said in response to another question on the separation.

Papa wasn’t willing to be more specific responding to questions about potential additional spin-outs from within the Bausch Pharma business that will remain after the Solta Medical and Bausch + Lomb separations.

“About any intention to do anything further with any of our other businesses,” he said, “as a company, we knew going back to 2016, we had too much debt. I think at that time, we had over $32 billion of debt. We paid down $9.5 billion of debt since that time. But we knew we had too much, and we've been working very diligent to reduce that debt.”

“I'll just leave it with excited to unlock what we think are three great businesses, the B&L pure-play eye health company, the Bausch Pharma global business and then … the Solta aesthetics business,” he added.

The CEO also noted Bausch Health has “also had to clean up some of the legacy legal issues” from regulatory and securities violations when the firm operated as Valeant. Those added up to “somewhere in the $2.5 billion range.”

“We've had to clean up, I'd say, somewhere close to $12 billion of some of the challenges we found ourselves in going back five years,” Papa said.

Investors apparently expected more from Bausch Health. Its results promoted trading at more than five times average volume on the New York Stock Exchange-NASDAQ that led to a 10.76% drop in its share price at close, $26.46.