Perrigo Steers Through Transportation Obstacles, Soaring Shipping Costs From COVID-19

Divesting ScarAway Wound-Care Brand Required For US FTC Approval Of HRA Acquisition

Executive Summary

Perrigo largely has resolved distribution problems, but shipping freight costs still are much higher than pre-pandemic and it must divest a wound-care brand before US regulators sign off on acquisition of HRA Pharma, says CEO Murray Kessler during J.P. Morgan conference.

Perrigo Company PLC is working through challenges concerning not having enough of some things while having too much of one thing and paying significantly more than it historically has for another.

President and CEO Murray Kessler says, like its competitors in the global consumer health market space, Perrigo has been hit during the COVID-19 pandemic by shortages of trucks and drivers to distribute its products and of employees in its factories and warehouses.

The Dublin-based firm largely has resolved those problems, Kessler said on 12 January at the JP Morgan Healthcare Conference conducted online.

But it’s shipping freight costs still are much higher than pre-pandemic and it must divest a wound-care brand before US regulators sign off on its planned acquisition of HRA Pharma, officially identified in France as Héra SAS, for €1.8bn ($2.1bn) in a cash deal that would propel Perrigo into the top three globally among consumer health product manufacturers. (Also see "Perrigo Continues Overhaul Adding HRA Pharma, Boosts Chances For OTC Oral Contraceptive In US" - HBW Insight, 8 Sep, 2021.)

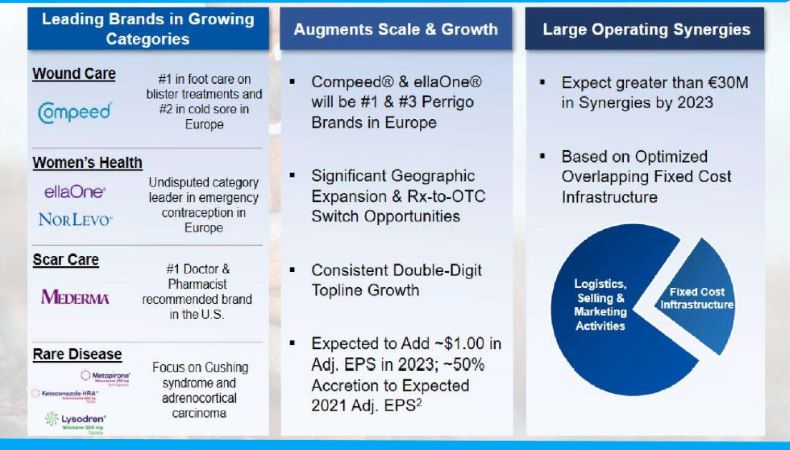

Adding HRA's EllaOne (uliprista/30 mg) emergency contraceptive, approved for OTC sales in some European markets, will particularly be a boost for Perrigo’s sales totals (see image below).

HRA Acquisition: Immediately And Significantly Accretive

perrigo's J.P. Morgan conference presentation included this slide with forecast for impact of its pending acquisition of french firm hra pharma. Estimates are based on data available at announcement of deal in September; 2 indicates based on november guidance of $2 to $2.10.

Source: Perrigo

perrigo's J.P. Morgan conference presentation included this slide with forecast for impact of its pending acquisition of french firm hra pharma. Estimates are based on data available at announcement of deal in September; 2 indicates based on november guidance of $2 to $2.10.

Source: Perrigo

“It's not a roadblock – it’s just time,” Kessler said of the Federal Trade Commission’s requirement that Perrigo divest its ScarAway line of sprays and sheets to satisfy the agency’s concerns that the firm would have an anti-competitive share of the US OTC wound-care market when combined with HRA.

The deal to acquire the French firm announced in September has received all necessary ex-US regulatory approvals, the CEO said, adding that he expects the FTC also will grant approval with a ScarAway sale.

“It just takes a few months. … It's productive, good conversation, FTC asking lots of questions as they always do, but crossing their t's and dotting their i's. But I believe by mid-year we'll have this done,” Kessler said.

Shipping Containers: From $6,000 To $26,000, Now $20,000

While trucking shortages in the US have slowed manufacturers’ deliveries of consumer health and other products to retailers and other customers, the pandemic also has impacted the firms’ supplies for making products.

Shipping not only is slower for Perrigo, like businesses across industries, is paying more in freight costs. (Also see "Like COVID-19 Impact On Supply Chain, Expert Says Global Demand For Goods ‘Unprecedented’" - HBW Insight, 17 Sep, 2021.)

“The big cost, the big freight cost is inbound freight,” Kessler said.

Shipping containers from China pre-pandemic would cost the firm around $6,000. The firm’s costs jumped during the pandemic to $26,000 per container before dropping recently to around $20,000, he said.

Omicron, Cough/Cold Sales Driver

Omicron, the COVID-19 variant known to spread more easily while causing less severe symptoms, also apparently has been good for consumer health firms’ sales of cough/cold products.

Massively widespread use of masks to prevent the spread of COVID-19 since mid-2020 also has significantly limited the spread of germs, tanking sales of cough/cold OTCs since then. (Also see "Perrigo Feels Chill From Q3 Results Due To ‘Unfulfilled’ Demand On Supply Chain Disruptions" - HBW Insight, 10 Nov, 2021.)

However, the emergence of the Omicron virus has consumers buying up those products.

Perrigo already was expecting regaining around 80% of its 2019 cough/cold product sales levels before Omicron emerged, Kessler said, adding that 2019 “was a very strong cough/cold year.”

“Then you come to Christmas, Omicron comes and stores were wiped out and … You wouldn't have seen that in the fourth quarter, but all of our big customers are now calling upping their orders based on what's happened at retail … Literally everybody was calling me saying there's no cold/cough products in my stores, anybody who knows us, works with us, et cetera,” Kessler said.

The same’s true for Perrigo in Europe. And its business there is predominantly national or regional brands, with price increases made more simply. “Likewise, it's been a strong resurgence in the cough/cold business. So, they have similar big increases in cough/cold. They have different dynamics in gross margin, and they can price.” Kessler said.

“But it's holding there right now. … we think by midyear, that will break and start to come down again.”

Perrigo isn’t making the same prediction for supply costs. “Some of the other material costs, we have no estimate of them coming back yet. But we've been able to pass through in cooperation with our customers on real price increases,” Kessler said.

Raising prices is more complicated for Perrigo, as a predominately private label and store brand product provider in the US, than for its competitors making and marketing their own brands. With retailers and distributors selling Perrigo-made products as their own, lower-priced alternatives to equivalent national brands, the firm’s customers are sensitive about raising prices even when its costs increase.

“We're a supplier, we have contracts. We have to go in and negotiate. Generally speaking, they have a team of people that analyze – is it true, are the costs really up?” Kessler said.

Shipping and distribution costs, though, aren’t factors that influence Perrigo’s customers. “They'll work with us on material price increases, not in efficiency. They say that's our problem and I get it,” he said.

Still, following the 2021 third quarter, after several years of 2% to 3% price erosion, Perrigo’s average pricing was up. “It's already started to show itself. From the minus 1% to 2% in the last few years, I'm hoping to get plus 1% to 2% in 2022,” the CEO added.

Perrigo, which has yet to set a date for publishing its 2021 fourth-quarter and full-year results, in November reported third-quarter net sales up 4% to $1.04bn. Net sales grew 4.6% for its Americas division to $694m and 2.8% to $349m for its international division.

More Drivers, Shifted Loads

Negotiations also were part of solving Perrigo’s distribution backup.

“We signed up regional carriers and we over-ordered on truck drivers at a cost. Some days that was a good thing, some days was a bad. Bottom line is we were able to get out everything we had ordered at a cost. But we have solved it,” Kessler said.

Part of the solution involved changing the assortment of products loaded on trucks. Some products loaded on temperature-controlled trucks could go on others.

“They didn't need that. The first way to relieve stress on the system was to move them back to the third-party supplier that had them before. We got that done by the middle of the [fourth] quarter, freed up a lot of space for higher margin OTC products on the trucks,” Kessler said.

Staffing at production and warehouse facilities remains affected by the pandemic. “The big unknown, and which has cost us a lot of money, is the employees, the absenteeism. We have at any given time right now 150, 200 people … out with COVID or they've come into contact with somebody in COVID,” he said.

Public health authority standards had required 10-day quarantines for people exposed to COVID and recently trimmed to it five days.

“That means everybody else is working overtime. You're paying the people that are off and you're paying everybody else overtime and over a sustained period of time, that's a lot of money,” Kessler said

“Those absentee numbers, when we get this under control and I guess the shining hope is that Omicron is like what finally gets us to herd immunity and we get past this that we'll recover those costs, too.”

Kessler's comments apparently didn't encourage investors. After a generally upward trend since late December, Perrigo's share price dropped the same day and for the next two days at average volume trading. From closing up slightly at $41.85 the day before the CEO's J.P. Morgan presentation, the price dipped steadily to a close of $39.63 on 13 January before a slight increase to end the week at $39.72.