Transparency Drives Novi's Online Connections For Cosmetic, Dietary Ingredient Buyers And Sellers

Executive Summary

Start-up provides platform for suppliers' information about sustainability and other business practices and transparency about ingredients, packaging and other materials. “When you think about ingestibles and vitamins, a lot of companies are starting lines that are in skincare and cosmetics," says CEO Kimberly Shenk.

Dietary and cosmetic and personal care ingredient suppliers sometimes aren’t their best options for connecting with their target markets, and some businesses in those markets often won’t find the best suppliers for their needs on their own.

That’s what Kimberly Shenk sees as co-founder and CEO of Novi Connect Inc., an ingredient database and transaction platform she launched in the cosmetic and personal care space before recently expanding into dietary ingredients.

“We are listing actual materials that are being developed, developed by raw material suppliers. They're listing those materials to sell them, they essentially are looking for new business,” Shenk told HBW Insight.

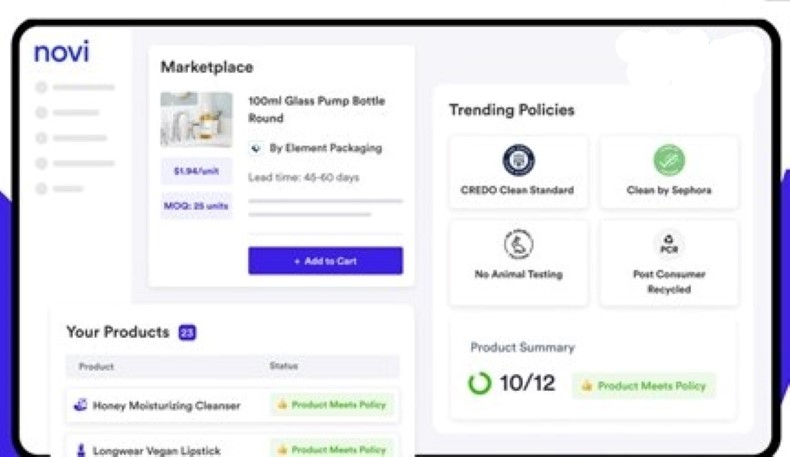

San Francisco-based Novi provides a platform for suppliers to publish information about their sustainability and other business practices and be transparent about their ingredients, packaging and other materials. It also has financing available for buyers.

![]() Ceo kimberly shenk developed novi connect because she "was shocked at the lack of information there was in the industry when you're sourcing materials."

Source: Novi Connect

Ceo kimberly shenk developed novi connect because she "was shocked at the lack of information there was in the industry when you're sourcing materials."

Source: Novi Connect

“There's supply chain and sourcing information, where the feedstock came from, the manufacturing process. There's a whole wealth of information on top of that – was this derived from animal byproducts, if it was derived from palm oil, was it responsibly sourced palm oil?” Shenk explained.

“There's a whole bunch of that kind of information that we're able to provide.”

Overlap Between Markets

Shenk’s entry into operating an online connection between suppliers and buyers started from her own experience as a principal with the NakedPoppy cosmetics and skin care brand.

“I've been a data scientist my entire career and have been in software development. So that's been my focus, but … I actually ended up being part of that brand, building a brand and got very close to the manufacturing side, and was shocked at the lack of information there was in the industry when you're sourcing materials, and I thought of the massive data problem,” she said.

“A lot of the solution that we built has been to solve that problem, but also use it with my background and extensive knowledge of how to build data products.”

Novi expanded to include dietary ingredients because businesses in the cosmetic/personal care or sector increasingly are selling in both markets, with cannabinoids a particular overlap driver.

“When you think about ingestibles and vitamins, a lot of companies are starting lines that are both in skincare and cosmetics and also in that area. We're really leaning into that more and more,” Shenk said.

More Dealmaking Online During Pandemic

Novi launched in early 2020, “right around when everything happened,” Shenk recalled.

But the widespread shutdowns to business travel and in-person meetings in general at the COVID-19 pandemic began apparently helped Novi.

“Their trade shows shut down and sales calls stopped, and there needed to be an online way to do this. We definitely experienced benefits from the tail end of COVID,” she said.

Online home goods seller Wayfair Inc. says an expected massive shift of consumer health and cosmetic product sales from stores to online has been accelerated by three to five years by the pandemic. (Also see "With More Consumers Shopping Online During COVID-19, How Do Marketers Keep Them There?" - HBW Insight, 8 Nov, 2021.)

For the beauty industry specifically, consumers’ mass migration online during the pandemic and the exploding telehealth opportunity have kicked investment in digital technologies and services into high gear. (Also see "More Big Beauty Companies Partner With Digital Tech To Guide Consumer Journey" - HBW Insight, 17 Jan, 2022.)

“We work with a ton of brands who exclusively started off in skincare and then all of a sudden started seeing a whitespace opportunity in wellness and getting into ingestibles. CBD is becoming very popular and it's driving a lot of that,” she added.

“We saw that as a really interesting opportunity to expand the network so we can service those brands. Then we just saw a lot of organic inbound from brands asking if we could do that for them. All those different pieces together has allowed the expansion.”

SMBs Attract Suppliers

Shenk’s start-up experience at NakedPoppy also showed her that connecting with suppliers of ingredients and other materials or services the businesses needed wasn’t efficient or cost-effective. Small and medium-sized businesses, she said, often don’t have staff or time nor the money to make deals.

“Our main target market is the SMB market, the small indie, up-and-coming brands. From our perspective, suppliers are most excited about that aspect of the platform, because they are trying to break into that market,” Shenk said.

“It's the hardest market to service because it's very operationally intensive. And nobody takes care of all of that on their behalf.”

Novi receives commissions on transactions made through the platform, the amounts determined by the size of a deal and the businesses and ingredients involved.

Firms that need help locating good supply deals and the suppliers providing the goods are “very receptive” to Novis’ business model, Shenk said. “It's a huge, huge range and also dependent on brand size.”

Larger businesses marketing dietary supplements and cosmetic/personal care products “already have those relationships. They have those negotiations in place for what price they're going to sell their materials for,” she said.

“That's where the pushback would come in. But on the smaller brands, they're just trying to get discovered by them and we can actually be that tool to get bring them business. … These smaller brands don't have the capabilities, the technology, the access, so it's something we could provide right away out of the gate.”

Novi began connecting buyers and sellers after initially launching with an information platform.

Buyers have access to information about dietary and cosmetic ingredients on novi connect's online platform before deciding on purhcases also done on the platform. Source: Novi Connect

“We did focus on the data angle, which is still a huge part of our core value, but discovery and connection and we moved more into actually facilitating the transaction so that the brand could access and purchase the material,” Shenk said.

“That's usually a big barrier. Even though they find a material that they love, they don't have the means to be able to purchase it.”

$51M Funding So Far

In addition to commissions from deals made through its platform, Novi receives monthly fees from marketers and other businesses for ongoing access to the information, often for verifying products against industry or third-party standards and certifications.

Providing financing for some buyers is supported by the more than $51m in funding its raised, including $40m earlier in 2022.

Dietary ingredients probably won’t be the end of Novi’s expansion. Pharmaceutical ingredients are among other markets on its list of potential targets.

“I think that's an area that especially when we think about, like the pharma industry at large – that just gets very exciting. We see that, but also, we've seen strong pull into other categories, like household cleaning, and food,” Shenk said.

“I think there will be a point in time where we'll have to make a decision of where we want to go next. But all of those are definitely top of the list.”