Private Equity Firm Yellow Wood Plans Refresh For Suave Beauty, Hair Products In US, Canada

Executive Summary

Suave hair and beauty brand getting new home in US and Canada at private equity firm Yellow Wood Partners, which plans to grow line through innovation, marketing and distribution. Unilever maintains ownership in other regions.

Yellow Wood Partners LLC will invest in development of the Suave hair and beauty line, unlike current owner Unilever PLC, and sees its planned acquisition of US and Canadian rights to the brand as a platform to add more beauty products to its portfolio.

In a deal for an undisclosed price expected to close in the second quarter, Yellow Wood will purchase all assets of the 85-year-old brand, including its dozens of hair care, body wash, skin care and antiperspirant products for women, men, teens and babies.

Suave’s sales reached $663m in North American outlets for the 52-week period through 28 January, according to Nielsen data.

Yellow Wood managing partner Dana Schmaltz says the private equity firm saw opportunities to invest in Suave, unlike Unilever which has focused on “reshaping” its portfolio toward the “biggest and best” brands and pursuing “selective disposals” of remaining businesses.

“Our thought was that if we could actually put more focus on the brand, we’d actually be able to take those great consumer metrics and drive the brand to growth,” Schmaltz said in a 21 February interview.

dana schmaltz: “The way we tend to operate is once we get a brand, a very solid brand like Suave, we tend to use that as a platform to add other brands into it."

Source: Yellow Wood

dana schmaltz: “The way we tend to operate is once we get a brand, a very solid brand like Suave, we tend to use that as a platform to add other brands into it."

Source: Yellow Wood

He likened the strategy to Yellow Wood’s acquisition of the Dr. Scholl’s brand from Bayer AG in the Americas in 2019 and the related Scholl brand from Reckitt Benckiser Group PLC in all other parts of the world in 2021. For both Bayer and Reckitt, the foot care brand was not a core-focus line. (Also see "RB Shows Scholl The Door, While Welcoming In Biofreeze" - HBW Insight, 24 Feb, 2021.)

Yellow Wood will make a “significant” investment in marketing, including digital promotions, to attract younger consumers to Suave, which has mostly been promoted through TV, radio and print media.

It also will ensure the mass market brand maintains its value appeal, especially given the economic challenges consumers are facing.

“We went for 12 years where money was free, low interest rates and high employment and a robust economy. You’ve got a generation of people who have come out and not experienced a recession before,” said Schmaltz, a co-founder of Boston-based Yellow Wood in 2011.

“This brand right now skews a little older and it’s something that we believe has great potential to further penetrate the demographic, but also to bring the younger consumers into it with this understanding of value,” he added.

“If you have the right product at the right price for consumers and you let them understand that, it tends to be a recipe for success,” Schmaltz said. Suave products, he added, are “as good or superior to many more high-price products.”

Suave Naturals costs $2.99 for 22.5 ounces, while Suave Men’s Body Wash retails at $7.99 for 15 ounces.

For Unilever, which retains Suave ownership outside the US and Canada, its sale of the brand in North America represents “another step on our path to shift our portfolio towards strategic growth spaces,” said Esi Eggleston Bracey, its US president and its Personal Care North America CEO, in a 14 February statement.

Unilever has identified key brands within its beauty and wellbeing business including Dove skin and hair care, Sunsilk and Clear hair care, Dermalogica skin care and Liquid IV hydration products. The UK firm on 9 February reported its beauty and wellbeing business had underlying net sales growth of 7.8% to €12.3bn($13.1bn) in 2022. (Also see "Unilever Delivers Q3 Growth On Pricing As US, European Consumers Tighten Purse Strings" - HBW Insight, 31 Oct, 2022.)

Platform For Growth

Yellow Wood, which also owns Freeman bare foot treatment and scrubs, Byoma skin barrier boosters and Tanologist sunless tanning among other niche brands, sees Suave as an opportunity to build out its hair and beauty business.

“One of the appealing aspects of Suave is that it is multi-category. So it’s not just hair care, it’s not just body wash, it’s not just [antiperspirant/deodorant],” Schmaltz said.

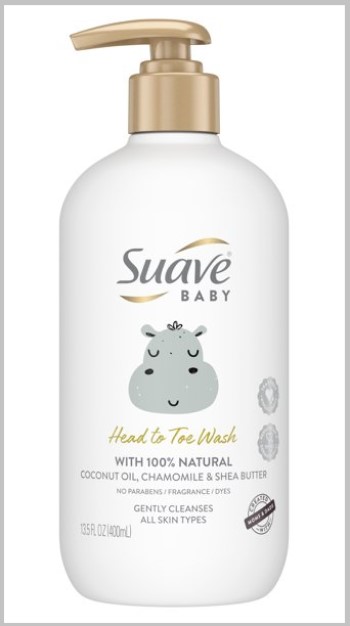

head to toe body wash is part of first suave collection for babies current owner recently Rolled out in Walmart.

Source: Shutterstock

head to toe body wash is part of first suave collection for babies current owner recently Rolled out in Walmart.

Source: Shutterstock

“The way we tend to operate is once we get a brand, a very solid brand like Suave, we tend to use that as a platform to add other brands into it. Our hope is to do what we call add-on acquisitions of smaller brands, which maybe might not have the distribution breadth of Suave, but [we] can grow those brands.”

Schmaltz lauded Unilever’s recent launch of Suave Baby, the brand’s first collection for babies. Rolled out in Walmart, the line includes Suave Baby Detangler Cream, Moisturizing Baby Oil, Curl Shampoo, Curl Conditioner, Curling Butter, Head to Toe Body Wash and Baby Lotion, each priced at $3.98 on Walmart.com. Unilever also recently introduced a teen-targeted line, Suave Pink.

“They’ve done a really good job with the brand and so we believe it’s ready to take off,” Schmaltz said.

More Room On Drug Store Shelves

Yellow Wood also plans to drive Suave “a little further” in distribution, notably in the drug store channel. “We look forward to working with our retail and e-commerce partners in an effort to drive the growth of the brand,” the firm noted in its release.

The firm also expects innovation to drive growth.

“We really do spend a lot of time on new product development and innovation. We do expect that to continue to accelerate again,” Schmaltz said.

Yellow Wood uses a “proprietary data analysis” to find the right brand and then its team of brand owners, sector specialists and investment professionals works to maximize the brand’s opportunity. The company currently owns nearly two dozen brands with its assets under management valued at $1.8bn, according to its website. (Also see "Unilever Vows No GSK-Sized Ventures For Foreseeable Future, Commits To Existing Brands In 2022" - HBW Insight, 10 Feb, 2022.)

Schmaltz noted the deal is an all-asset transaction. Yellow Wood plans to hire a new management team and make Suave a stand-alone entity within its portfolio.