Reaching 'Transformation' In Turnaround Phase 1, Perrigo Looks To Build On Its Accomplishments

Executive Summary

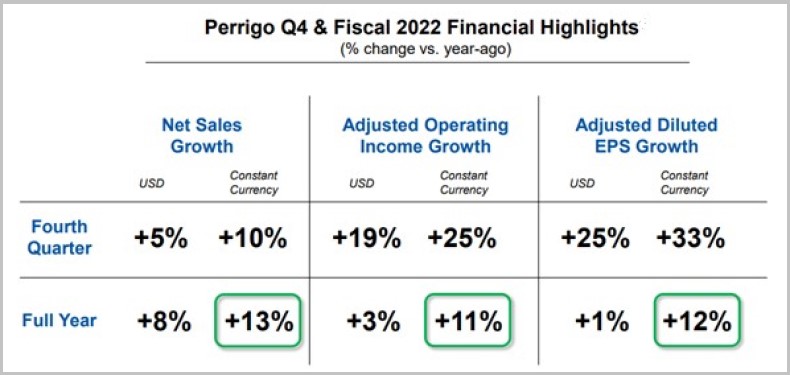

Day after releasing Q4 and full-year results, Perrigo announced launch of next chapter in its “3/5/7” makeover strategy. It reached annual growth of 3% for top line revenues in phase 1, aims for 5% operating income and 7% earnings per share growth in phase 2.

Perrigo Company PLC is turning the page on its makeover strategy, moving from transforming its portfolio and operations to optimizing its businesses while accelerating growth.

As the consumer health products private label leader touts its path ahead, shareholders likely are noting it ended each of the past two years with the same full-year net loss (see related story).

The firm on 28 February, the day after releasing its 2022 fourth-quarter and full-year results, announced it’s launching the next chapter in its “3/5/7” makeover strategy: reaching annual growth of 3% for top line revenues, 5% operating income and 7% earnings per share (see tables and graphs below for details).

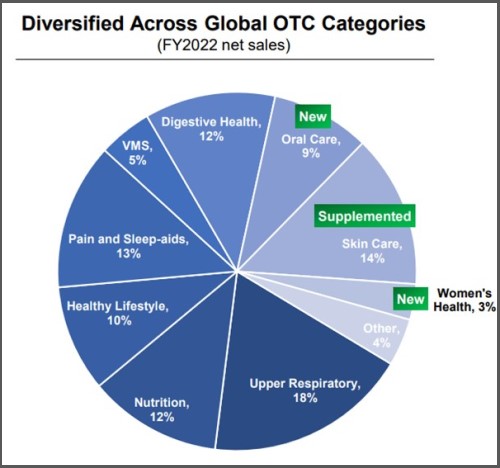

Perrigo's extension into women's health and oral care and its expansion in skin care added to the bredath of its portfolio and to its sales drivers.

Source: Perrigo

Perrigo's extension into women's health and oral care and its expansion in skin care added to the bredath of its portfolio and to its sales drivers.

Source: Perrigo

The Dublin-based firm says phase 1 of its makeover, “Transformation,” has been accomplished, including reaching 3% top line growth as well as reconfiguring its portfolio, stabilizing adjusted operating income for its consumer health Americas and international divisions and reducing uncertainty in its sales.

With phase 1 returning Perrigo to growth, it’s starting phase 2, “Optimizing & Accelerating.” Key priorities in this phase are delivering consistent growth of more than 5% adjusted operating income and more than 7% adjusted EPS.

CEO Greeted With

‘Long-Term Declining Trend’

President and CEO Murray Kessler pointed the consumer health products private label leader on its 3/5/7 growth strategy soon after joining the firm in 2018.

“The team and I walked into pretty tough situation. It was a long-term declining trend. You had about four years of declining 2% in total, kind of a flat consumer top line business and a declining Rx business and an overall declining operating income trajectory. And the share price was declining and the business was continuing to erode,” Kessler said to open the investor day conference Perrigo conducted with its results release.

“A massive reconfiguration of this company” was needed, “and we literally in the last three years,” he added.

The transformation for the firm which maintains its primary operations in Grand Rapids, MI, included selling its Rx generic topicals business and its other prescription drug manufacturing and development interests, its Latin American operations and its animal health business.

Numerous phase 1 additions included most recently the Good Start infant formula brand in the US and Canada along with a formula production facility from Nestle. (Also see "Perrigo Adds Good Start Brand In $230M Statement On Boosting Infant Formula Production Capacity" - HBW Insight, 1 Nov, 2022.)

Most notable among the additions was Perrigo’s acquisition of French firm HRA Pharma in 2022, expanding it into the contraceptive sector, including the first proposed US OTC daily oral contraceptive as well as HRA’s OTC and Rx products marketed in the US, Europe and other regions. (Also see "Perrigo Continues Overhaul Adding HRA Pharma, Boosts Chances For OTC Oral Contraceptive In US" - HBW Insight, 8 Sep, 2021.)

Also notable was its 2020 move targeting clinical trials with cannabidiols with a $50m investment in hemp cannabinoids supplier Kazmira LLC. (Also see "Safety First For Perrigo In CBD Market; ‘Long-Term’ Play Starts With Clinical Trials" - HBW Insight, 8 Aug, 2020.)

perrigo emphasized differences from excluding losses to foreign exchange for its net and adjusted results for 2022 Q4 and full year during its investor day presentation.

Source: Perrigo

perrigo emphasized differences from excluding losses to foreign exchange for its net and adjusted results for 2022 Q4 and full year during its investor day presentation.

Source: Perrigo

Kazmira “is on the leading edge of developing clean CBD products. So that was the portfolio reconfiguration,” Kessler said.

“Imagine the amount of work it took to pull off like 13, 14 transactions like that in the last couple of years. I truly believe that M&A capability and integration capability is a core competency at Perrigo,” he added.

Results Point To ‘More Upside Than Downside’

Perrigo’s results have analysts expecting an upturn for the remainder of 2023, while the latest in its growth strategy has their support if not belief.

JP Morgan pharmaceuticals, major and specialty, market analysts described the quarterly results “as highlighting a path towards [Perrigo’s] results recovering over the next several years after a challenging few years of results.”

“While it will likely take several [quarters] of consistent performance for [Perrigo’s] valuation to normalize, we continue to see more upside than downside for shares at current levels,” JP Morgan’s analysts added in a 28 February research note.

Managing Scale And Complexity

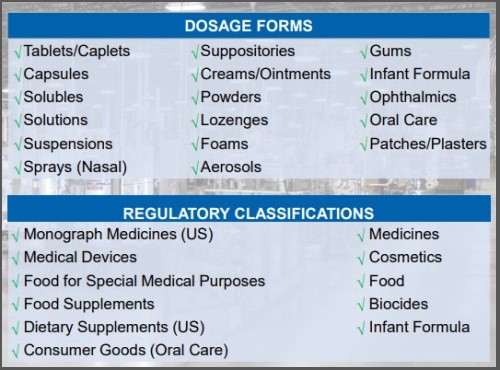

PERRIGO says KEY TO BEING "A LEADING, PURE PLAY, GLOBAL CONSUMER SELF-CARe company" is managing the scale of its portfolio and distribution network, above, and the complexity of its product forms and regulatory approvals, below.

PERRIGO says KEY TO BEING "A LEADING, PURE PLAY, GLOBAL CONSUMER SELF-CARe company" is managing the scale of its portfolio and distribution network, above, and the complexity of its product forms and regulatory approvals, below.

They noted that HRA’s portfolio and research aren’t yet adding to Perrigo’s valuation. (Also see "Opill Proposal Makes ACNU Sense, Stakeholders Comment On US 'Additional Conditions' Proposal" - HBW Insight, 11 Nov, 2022.)

The daily birth control pill proposal is an opportunity of around $100m “that does not appear to be reflected in [Perrigo’s] near-term guidance,” JP Morgan analysts say.

At Raymond James, Elliot Wilbur suggested a wait-and-see approach following Perrigo’s announcement of concluding phase 1 and beginning phase 2 of its makeover.

“While we believe margins have bottomed and the company has embarked on a journey to improved profitability and more consistent quarterly performance, we’ve seen this movie before with margin gremlins reemerging just when you thought the worst was behind the company, so we are reserving our seat in the conservative camp on numbers and valuation pending further execution validation,” Wilbur wrote in a March 3 note.

He pointed out phase 2, “code named operation Optimize and Accelerate,” is the “most radical overhaul of the company’s manufacturing supply chain in over 100 years.”

“It’s big, bold and gets to the heart of what is basically ‘wrong’ with the Perrigo model; it is too complex and provides customers with way too many menu options in terms of packaging, flavors, pill size, box count, etc,” Wilbur said.

“Imagine ordering a new vehicle and instead of the numerous options available for drivetrain, interior and exterior color, you could customize the height, width, length of the vehicle along having menu options for conceivable component where there is potential choice.”