Aspirational Products Driving Growth In Developed OTC Markets

Executive Summary

Aspirational OTC products such as probiotics are outstripping demand for traditional symptom relievers, IQVIA's Andy Tisman told the recent Ceuta International Conference. Consumer health players must adapt their portfolios to cater for the more health conscious, informed, and digitally-connected consumer, Tisman advises.

“Aspirational” health and wellness products are now driving growth in developed OTC markets as traditional symptom relief products struggle to attract new consumers, according to Andy Tisman, global lead, strategy & thought leadership at IQVIA Consumer Health.

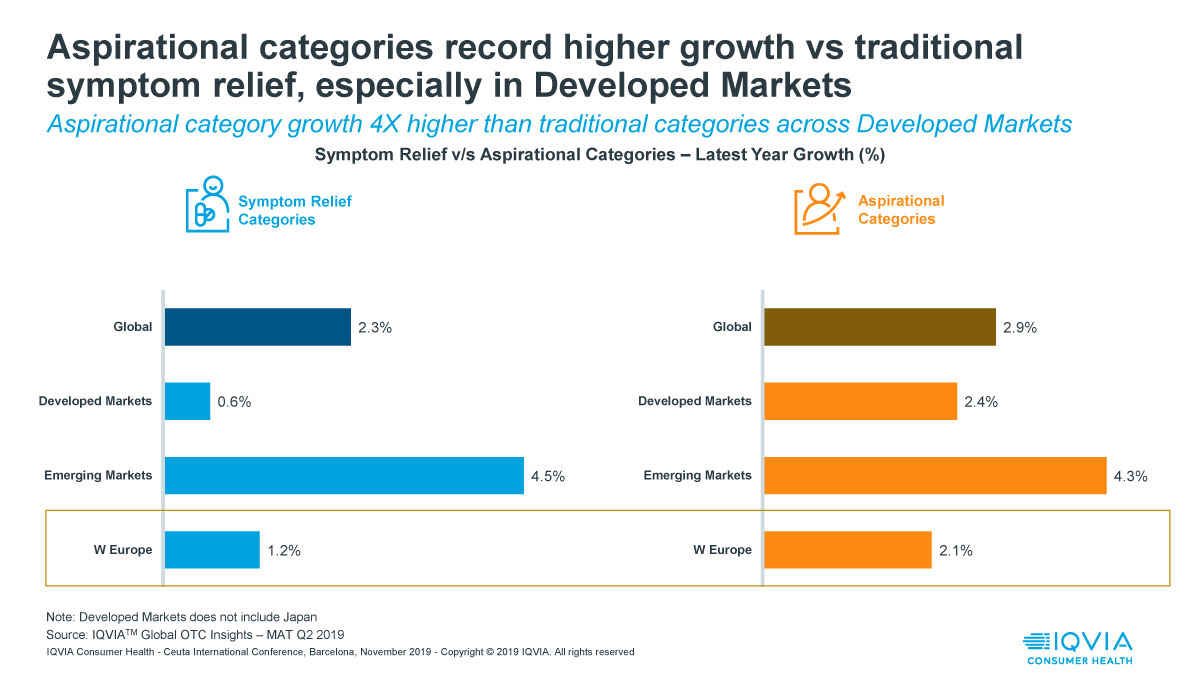

Addressing the 14th Ceuta International Alliance Conference in Barcelona, Spain, Tisman revealed that over the past 12 months the growth rate of the aspirational category had been four-times higher than that of the traditional category across developed markets, covering North America, Western Europe and Australasia.

“The challenge with the traditional symptom relief categories is that the demand is limited by the incidence of illness, as well as by consumers’ willingness to treat,” Tisman explained. “But when it comes to the aspirational side of health and wellness, demand is potentially limitless.”

In developed markets, the aspirational category – which includes products such as probiotics for digestive health, vitamins, minerals and supplements (VMS) and calming/mood enhancing lines – had grown by 2.4%, Tisman pointed out, whereas the symptom relief category – covering traditional OTC products for cold and flu, pain relief and heartburn – had edged up by just 0.6%.

At a global level, aspirational was also outstripping traditional category growth, Tisman noted. While aspirational only accounted for 30% of total OTC categories worldwide, six of the 10 fastest-growing categories were aspirational ones.

Shift In Consumer Behavior

Driving this demand for more aspirational products was a significant shift in consumer behavior from a reactive to a proactive approach towards their own health care, Tisman explained.

“We know that technology gives the consumer much more opportunity to be in control of their own health care and they are taking advantage of that opportunity, using the internet to help them manage their own health,” he observed.

Consumers had “huge aspirations,” Tisman said, when it came to their health and well-being.

But while consumer preferences for OTC products have changed, many companies have not been as quick to respond, particularly the leading multinational players.

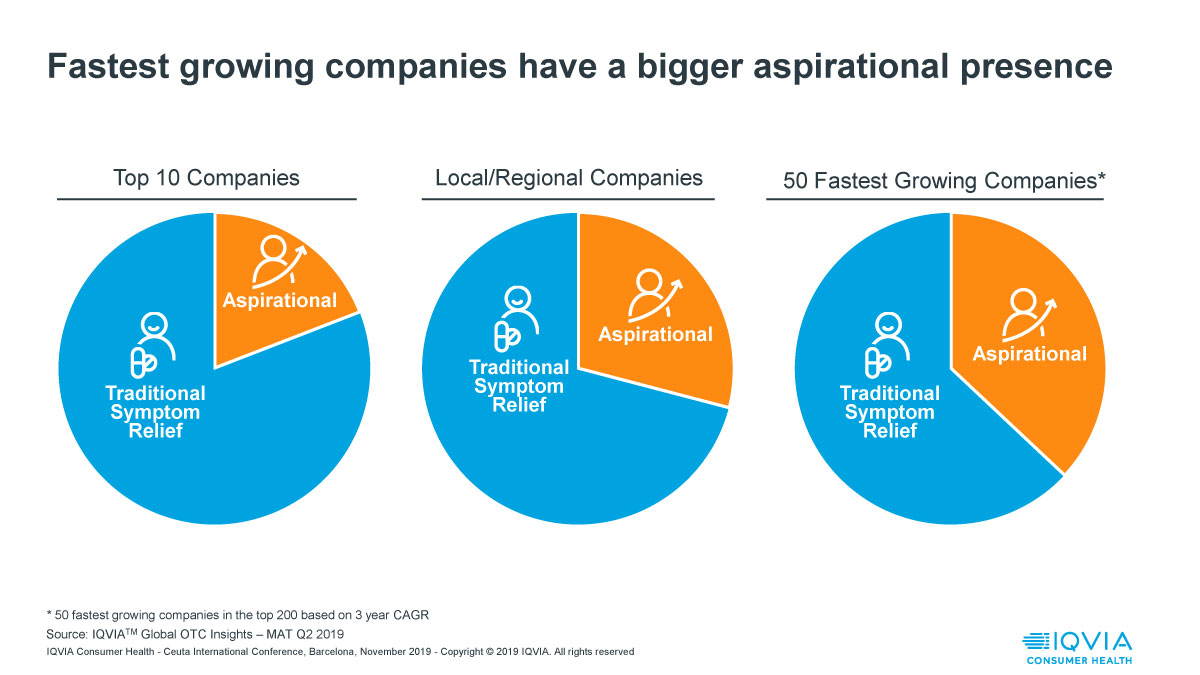

The top-10 companies in the global OTC market by value share had portfolios dominated by traditional symptom relief products, Tisman highlighted, with aspirational categories making up less than a quarter of the total.

These multinationals were on the whole struggling to match or exceed market growth, he revealed, with only three of the 10 doing so in the past 12 months, whereas those local, nimbler players with a significantly larger proportion of aspirational products in their portfolios were outpacing the market.

The 50 fastest-growing players among the top-200 OTC companies globally dedicated on average a third of their portfolios to aspirational categories, Tisman pointed out, significantly more than the multinationals. “There is a clear correlation between aspirational category portfolio weight and company growth,” he noted.

Time For A New Approach?

Increased desire among consumers for aspirational OTC products and stagnating demand for traditional symptom relivers meant industry’s approach to innovation had to change, Tisman insisted.

“We see the scope of innovation needing to increase to become much more genuinely consumer-centric,” he stressed, “providing significant new benefits for personalisation for the consumer and to become broader beyond symptom relief to much more holistic health and wellness.”

Consumers wanted OTC products that were “meaningfully different” than those already on the market, he said, backed by more rigorous scientific validation of the health benefits they claimed to offer.

“As consumer choice increases to this broader health and wellness spectrum, the industry has to think about how to bring the right solutions to consumers at the right time,” Tisman argued. “Consumers are definitely different, they’re expectations are changing, and the industry needs to think about how it can better meet the needs of these more health literate, engaged consumers.”